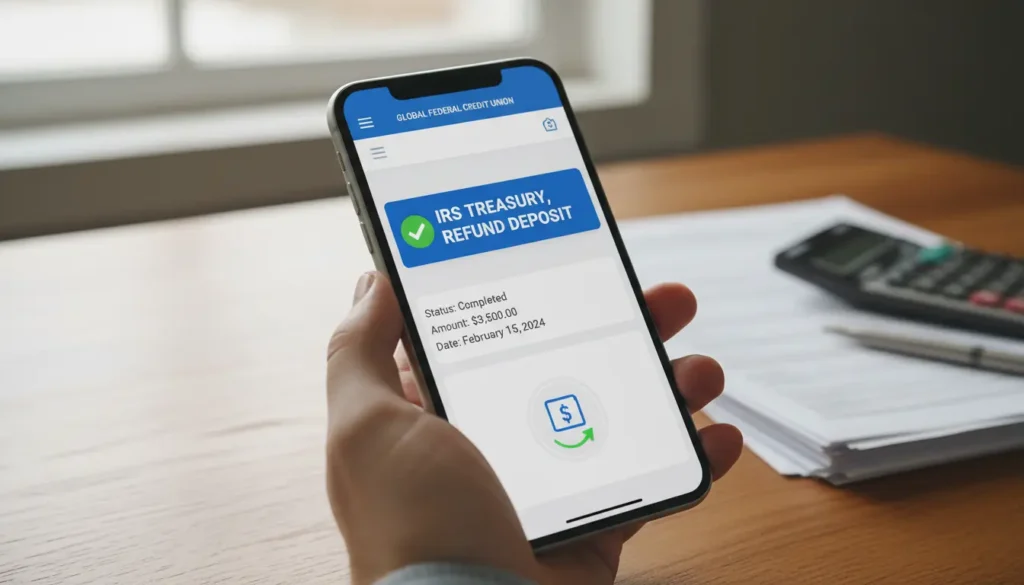

The IRS has confirmed a $2,000 direct deposit payment for 2026. This article explains the new eligibility rules, how to confirm you qualify, and the steps to get your money deposited into your bank account quickly and securely.

IRS Confirms $2,000 Direct Deposit for 2026: What the announcement means

The IRS confirmation signals a one-time payment program for eligible taxpayers in 2026. The agency’s statement describes who may receive the payment and the basic process for delivery.

Key points from the announcement include the payment amount, the use of direct deposit where possible, and the requirement that recipients meet specific eligibility criteria. Read on for practical details and how to prepare.

New eligibility rules for 2026: Who qualifies

The IRS has outlined new rules that determine qualification for the $2,000 direct deposit. The rules focus on filing status, identification, and recent tax or information returns.

- Valid taxpayer identification: Individuals must have a valid Social Security number or other qualifying taxpayer ID.

- Recent filing requirement: Typically, recipients must have filed a recent federal tax return or provided equivalent information to the IRS.

- Income and household tests: Eligibility may consider adjusted gross income, household size, and dependency status.

- Non-filer pathways: The IRS often provides a registration or non-filer portal for people who do not normally file returns.

- Payment timing and method: Direct deposit is prioritized when the IRS has bank account details; otherwise, alternative delivery methods may be used.

Who is likely to qualify

While exact thresholds can vary, the following groups are commonly included in similar IRS payment programs:

- Low- and moderate-income families who filed tax returns.

- Older adults and retirees with Social Security numbers and qualifying income.

- Households that claimed certain tax credits or reported dependents on recent returns.

- People who used the IRS non-filer registration when offered in prior programs.

How to check if you qualify and when you will get your deposit

Follow these steps to confirm your eligibility and expected timing.

- Visit IRS.gov and look for official information about the 2026 payment program.

- Use the IRS online tools — such as “Get My Payment” or a similarly named tracker — if made available for this program.

- Ensure your most recent tax return is filed and accepted by the IRS.

- Confirm your bank account and routing number are on file with the IRS to receive direct deposit.

If you believe you qualify but do not see an expected payment, contact the IRS or use official online tools to verify your record and update details.

How to update or add direct deposit information

Getting the payment by direct deposit is generally the fastest option. These steps will help you provide or update payment information.

- Log in to the IRS online portal (if available) and go to the payment information section.

- Enter your bank routing and account numbers carefully. Double-check for accuracy.

- If you cannot use the IRS portal, check your tax return for an option to provide direct deposit details when you file.

- Keep records of confirmations and any reference numbers the IRS provides.

Security and common mistakes to avoid

Protect your information by using official IRS channels only. Beware of scams asking for fees or sensitive details by phone or email.

- Do not share SSN or bank details with unsolicited callers.

- IRS communications will not demand payment for delivery of the direct deposit.

- Verify any email links by navigating directly to IRS.gov rather than clicking links in messages.

Direct deposit is usually faster than paper checks. Once the IRS releases payments, direct deposits can appear in accounts within days, while mailed checks take several weeks.

Small real-world example

Case study: Maria is a single parent who filed her 2025 tax return and listed a checking account for refunds. When the IRS confirmed the $2,000 payment program, she checked the IRS portal. The portal showed eligibility and a pending direct deposit date.

Mistake avoided: Maria verified her routing and account numbers before the payment was sent. When the deposit arrived, it matched the IRS record and posted immediately to her account.

What to do if you don’t get the payment

If you expected the $2,000 direct deposit but did not receive it, follow these actions:

- Re-check the IRS online status tool for updates or required actions.

- Confirm your tax filing and bank details were entered correctly.

- Look for mailed notices from the IRS explaining issues or next steps.

- Contact the IRS directly using phone numbers listed on IRS.gov if issues persist.

Final checklist to prepare

Use this checklist to make sure you are ready for the 2026 direct deposit.

- File your 2025 federal tax return or use the IRS non-filer process if you do not normally file.

- Confirm you have a valid Social Security number or qualifying taxpayer ID.

- Provide accurate bank account and routing numbers to the IRS.

- Monitor your IRS account and official IRS communications for status updates.

Staying informed and keeping your records up to date are the best ways to ensure you receive the $2,000 direct deposit smoothly. Always rely on information posted on IRS.gov and avoid unofficial sources.