The IRS has announced a new $2,000 direct deposit program that will start issuing payments in January 2026. This article explains what the IRS 2000 direct deposit update means, who qualifies, the rules to watch, and practical steps you can take now to be ready.

What the IRS 2000 Direct Deposit Update Means

This update refers to a one-time payment of 2000 that the IRS will send via direct deposit or check beginning in January 2026. The program is targeted at eligible taxpayers based on income, filing status, and recent tax or benefits records.

Payments will be issued automatically for most eligible people using bank account information already on file with the IRS, Social Security Administration (SSA), or other federal benefit systems. If the IRS does not have deposit information, a mailed check or debit card may follow.

Who Qualifies for the IRS 2000 Direct Deposit

Eligibility rules are based on the official IRS guidance. Below are the typical qualifying points to review:

- Valid Social Security number or ITIN and U.S. residency.

- Income at or below specified limits for 2024 or 2025 tax year (watch for official thresholds).

- Filed a 2023 or 2024 federal tax return or received federal benefits reported to the IRS.

- Not claimed as a dependent on another taxpayer’s return.

Exact income thresholds and phase-outs can differ by filing status. Check the IRS page for final rules once released.

Common exceptions and disqualifiers

- Individuals without a valid SSN for tax purposes may be ineligible.

- Nonresident aliens typically do not qualify unless specified.

- People with outstanding federal offsets (for example, certain debts) may see reduced or intercepted amounts.

When Payments Begin January 2026 and How They Arrive

Payments begin rolling out in January 2026. The IRS will use existing direct deposit data first, then shift to mailed checks or prepaid debit cards for those without bank details on record.

Expected arrival and verification steps:

- Direct deposit posted to the bank account on file; timing varies by bank.

- If the IRS lacks direct deposit info, a notice and paper payment will be mailed to the last known address.

- Recipients will receive an IRS notice showing the payment amount and payment method.

Immediate Steps to Take Now

Acting now reduces the chance of delays. Follow this checklist to prepare for the IRS 2000 direct deposit payments:

- Verify your bank account: Confirm the IRS has your current direct deposit details through your last tax return, IRS Online Account, or the Social Security Administration if you receive benefits.

- File or update tax returns: File any outstanding 2023 or 2024 returns as soon as possible to establish eligibility.

- Create or log into an IRS Online Account: This lets you check payment status and view notices.

- Update your address: Make sure the IRS and SSA (if applicable) have your current mailing address to avoid lost checks.

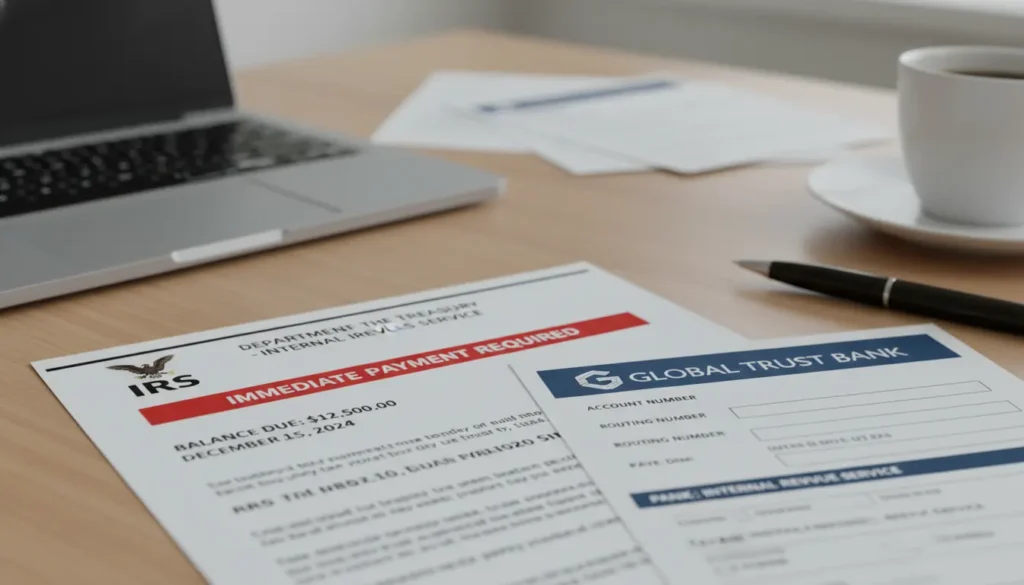

- Protect against scams: The IRS will not call to demand payment information. Use only official IRS sites (irs.gov) for updates.

The IRS typically issues notices after sending economic payments. If you get a notice, keep it for your records; it will contain the official payment date and amount for your tax reporting.

How to Check Payment Status

After January 2026, check status through your IRS Online Account or the specific IRS payment portal that will be updated for this program. Keep documentation of any notices or letters you receive.

If you expect a direct deposit but do not see it, confirm your bank routing and account numbers and compare them with the data on your most recent filed return.

Real-World Case Study

Case Study: Maria, a single parent working part-time, filed her 2023 taxes early and had direct deposit info on file. In December 2025 she confirmed her IRS Online Account contact details and updated her address. When payments began in January 2026 she received a direct deposit that matched the IRS notice. Because Maria kept records, she easily answered a bank inquiry and documented the payment for tax records.

What to Watch For: Rules, Scams and Appeals

Be alert for scams claiming to help you get the payment faster. Official IRS communication will come by mail or through your secure IRS Online Account, not by unsolicited texts demanding immediate action.

If you think you are eligible but do not receive a payment, follow these steps:

- Confirm eligibility against IRS guidance once the rules are published.

- Check IRS notices and your online account for information on withheld or offset amounts.

- Contact the IRS using phone numbers listed on IRS.gov or use the secure message feature in your online account.

Keep copies of tax returns, notices, and bank statements in case you need to appeal or document the situation.

In summary, the IRS 2000 direct deposit program starts January 2026 and will rely on data the IRS already has. Preparing now—by confirming your direct deposit info, filing required returns, and securing your accounts—will help ensure you receive any eligible payment without delay.