The IRS has confirmed a January 2026 direct deposit tied to a new tariff rebate plan. This article explains who is likely to receive the $2,000 deposit, how the plan is administered, and practical steps you should take to prepare.

IRS Confirms January 2026 2000 Direct Deposit: Key Facts

The IRS announcement sets a clear timeline for the tariff rebate distribution. The agency will start issuing direct deposits in January 2026 using existing tax records and bank information where available.

Officials say the rebate is funded from tariff collections and sent as a one-time payment to eligible households. Expect the IRS to publish eligibility details and an application window ahead of disbursement.

What the confirmation means for you

If you filed taxes recently, the IRS will likely use your 2024 or 2025 tax return data to confirm eligibility. Non-filers may need to register through a simplified online portal to receive a direct deposit.

Timing and amounts can vary by household; the frequently cited $2,000 is a typical single-payment example rather than a guaranteed sum for all recipients.

How the Tariff Rebate Plan Works

The tariff rebate plan returns part of federal tariff revenue to households. The IRS acts as the distributor, using tax files to determine recipients and deposit routes.

Core mechanics include collection, allocation, verification, and distribution. The IRS performs verification against income and filing status before sending funds.

Step-by-step mechanics

- Tariff revenue is collected at ports and through customs duties.

- Lawmakers authorize a portion to be returned to households as rebates.

- The Treasury allocates funds to the IRS for distribution.

- The IRS identifies eligible individuals using tax records and registration portals.

- Direct deposits and paper checks are issued based on available banking information and delivery options.

Who Qualifies and How Amounts Are Calculated

Eligibility depends on criteria set in the implementing legislation and IRS guidance. Typical factors include adjusted gross income (AGI), filing status, and residency status.

Amounts may be flat per eligible adult, proportional by household size, or phased out at higher incomes. Expect the IRS to provide a lookup or estimator tool once rules are finalized.

Common eligibility rules to watch

- US citizens and resident aliens with valid tax returns are usually first in line.

- Dependent rules determine if minors or other dependents add to household totals.

- Income phase-outs mean high earners may receive reduced amounts or none at all.

- Non-filers may need to sign up through an IRS portal with identity verification.

How to Prepare for the January 2026 Direct Deposit

Take simple steps now so the IRS can find you and send funds to the right account. Confirm your bank routing and account numbers on file with the IRS and update your address.

If you don’t file, plan to register through the IRS non-filer portal the agency will open. Keep documents that prove identity and residency ready for verification.

Practical checklist

- File your 2024 or 2025 tax return if required; keep records accurate.

- Check your bank routing and account on Form 1040 or IRS online profile.

- Sign up for the IRS online account and opt into electronic communication.

- Watch official IRS announcements for the non-filer registration link.

Important Dates and Timeline

Expect a phased timeline: final legislation, IRS guidance, registration window for non-filers, and then disbursement beginning in January 2026. The IRS will publish an FAQ and a timeline on IRS.gov.

Watch for direct deposit notices via your IRS online account, and check mail for any scheduled paper check dates if the IRS cannot deposit electronically.

Real-World Example: Small Household Case Study

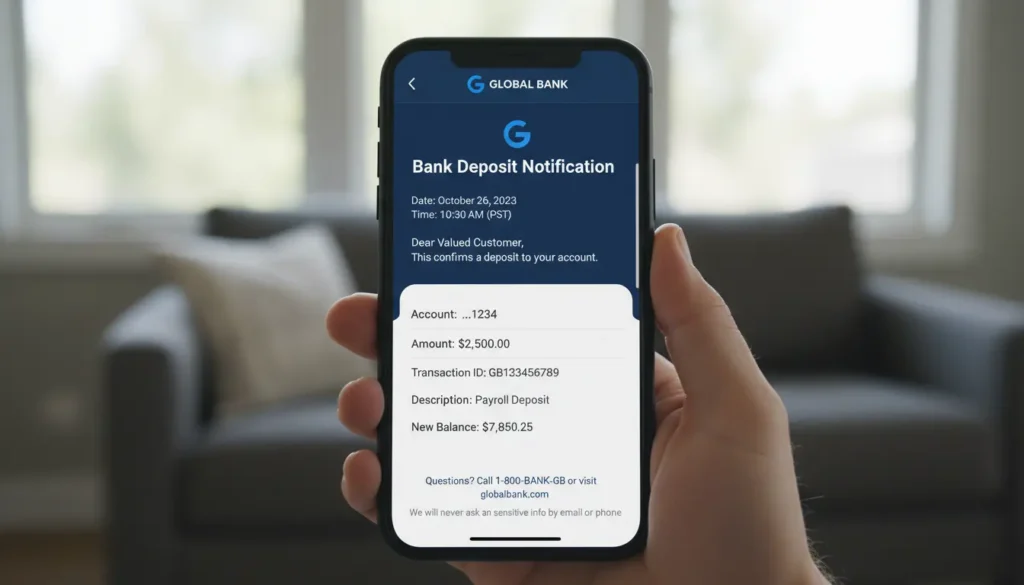

Case: A two-adult household filed 2024 taxes and claimed one dependent. Their AGI falls within the eligible range in the new law. The IRS has their bank details from direct deposit on file.

Result: The IRS approves the household and issues one direct deposit of $2,000 into the primary account in mid-January 2026. The family receives an IRS notice confirming the payment and the legal basis for the rebate.

Frequently Asked Questions

Will the rebate affect my taxes next year? In most cases rebates are not taxable income, but check IRS guidance and state treatment to be sure.

What if I moved or changed banks? Update your IRS profile and file your next tax return with current bank information. Non-filers should register the current bank details when the portal opens.

When to contact the IRS

Contact the IRS if you don’t receive a payment and believe you are eligible, or if the IRS sent a notice indicating missing information. Use official IRS contact methods rather than third-party promises.

Summary: The IRS confirmation of a January 2026 direct deposit under the tariff rebate plan means households should prepare now. Verify tax filings, update banking and contact details, and monitor IRS guidance to ensure you receive any rebate you qualify for.