The 2026 tax year brings two things taxpayers must watch: routine inflation adjustments and possible law-driven changes scheduled to take effect on January 1, 2026. This guide explains what to expect, how eligibility rules can shift, the likely payment schedule, and practical steps to prepare.

What to expect from IRS Tax Changes 2026

Each year the IRS updates inflation-adjusted amounts such as standard deductions, tax bracket thresholds, and retirement contribution limits. Those updates are usually announced in late autumn for the coming tax year.

In addition, some tax law provisions enacted earlier may expire or change at the end of 2025. That makes 2026 unusual: your tax rates or phaseout thresholds could change based on congressional action or lack of it.

Key categories affected by IRS Tax Changes 2026

- Standard deduction and tax bracket thresholds (inflation adjustments)

- Child and dependent tax credits or phaseouts

- Retirement plan contribution limits (401(k), IRA)

- Earned Income Tax Credit (EITC) parameters

- Alternative Minimum Tax (AMT) exemptions

Amounts: How IRS adjusts numbers for 2026

The IRS typically issues tables listing the new amounts for the tax year. These include updated bracket thresholds, standard deductions, and contribution limits.

Because Congress scheduled some tax law changes to expire after 2025, two scenarios are possible for 2026:

- If Congress extends current rules, you will see only inflation adjustments.

- If Congress does not act, several individual tax provisions could revert to prior law, raising marginal rates for many taxpayers.

Action item: Check IRS.gov when the official 2026 tables are released and review any congressional updates that affect tax rates.

Eligibility changes for credits and deductions

Eligibility for credits such as the Child Tax Credit or EITC is affected by both income thresholds and legislative changes. Any expiration or renewal of those credits will change who qualifies.

Watch for announcements about phaseouts, age limits, and earned income definitions that could change eligibility in 2026.

Common areas where eligibility shifts

- Income phaseout ranges for child and education credits

- Age and income rules for retirement catch-up contributions

- Residency and support tests for dependents

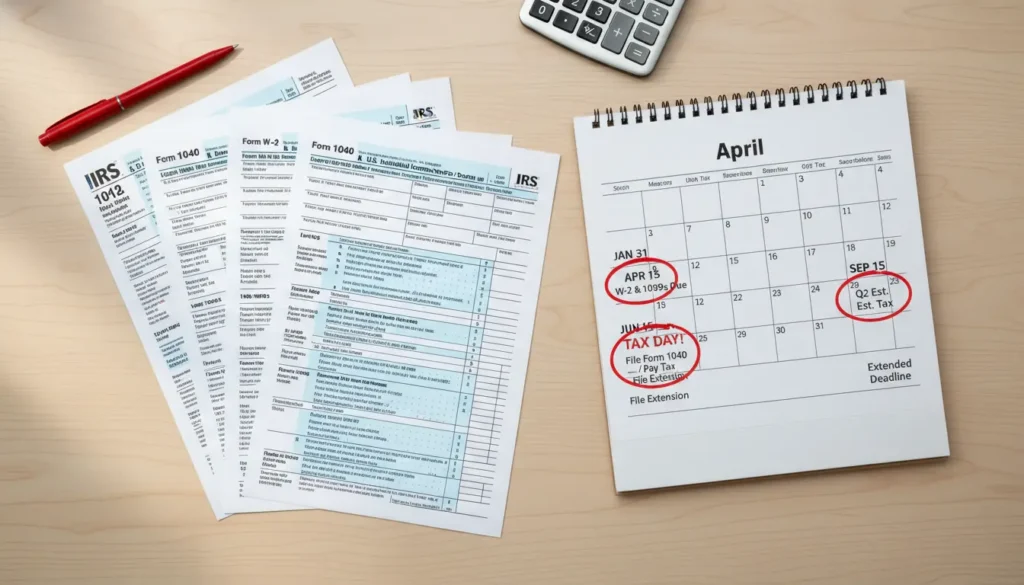

Payment schedule for taxes in 2026

Tax filing and payment timing remains governed by the tax calendar. For most taxpayers the key dates are stable, but know these general rules.

- Individual tax year: January 1–December 31, 2026.

- Estimated quarterly payments for 2026 income: usually due April 15, June 15, September 15, and January 15 (following year).

- Employer withholding occurs each pay period; updates to withholding should be made before the end of the year to affect 2026 withholdings.

If a due date falls on a weekend or federal holiday, the deadline typically moves to the next business day. State tax dates may differ.

How to prepare for IRS Tax Changes 2026

Start now so changes do not surprise you next year. Follow a few practical steps to reduce risk and avoid underpayment penalties.

- Review your 2026 withholding: use the IRS Tax Withholding Estimator when updated withholding tables are available.

- Make estimated payments if you expect income that isn’t subject to withholding.

- Max out retirement contributions where possible to lower taxable income.

- Track legislative news about tax law expirations that could affect your effective rate.

The Tax Cuts and Jobs Act included many individual provisions that are scheduled to expire after 2025. If Congress does not act, some taxpayers could face higher marginal rates starting in 2026.

Real-world example: small case study

Case study: Maria is a single public school teacher who expects $72,000 in 2026 W-2 wages. She currently has standard withholding and contributes 6% to her 403(b).

Scenario A — Only inflation adjustments: Maria’s marginal rate stays similar to 2025 but her standard deduction rises slightly. Her take-home pay increases marginally due to inflation-indexed brackets.

Scenario B — TCJA individual provisions expire: Maria’s marginal tax rate could increase when thresholds revert. She may owe more tax unless she increases retirement contributions or adjusts withholding.

Action Maria took: She updated her W-4 in December to increase withholding slightly and talked with her HR about increasing her 403(b) to reduce taxable income for the year.

Where to find official IRS Tax Changes 2026 numbers

Official numbers and tables are published by the IRS, generally on IRS.gov, and often available in late autumn for the coming tax year. Also monitor congressional news for any law changes that could alter those numbers.

Trusted sources to check:

- IRS.gov announcements and the annual inflation-adjustment tables

- Congressional budget or tax committee releases for law changes

- Tax professionals or payroll departments for employer withholding guidance

Final checklist for 2026 readiness

- Watch IRS announcements for the official 2026 tables.

- Review withholding and estimated payments before the first 2026 paychecks.

- Consider retirement contributions to lower taxable income.

- Consult a tax professional if you have complex income or expect major law changes to affect you.

Keeping these steps in mind will make the transition into the 2026 tax year smoother. Check the IRS site and trusted tax advisors for the finalized numbers and any legislative updates that could affect your taxes.