January 2025 Federal 2000 Direct Deposits Rules and Timeline — Overview

This guide explains likely rules and a practical timeline for federal $2000 direct deposits in January 2025. It focuses on common federal payment processes, what recipients should expect, and how to reduce delays.

Note: Exact dates and procedures come from the issuing federal agency and the U.S. Department of the Treasury. Confirm official announcements for final details.

What the phrase means

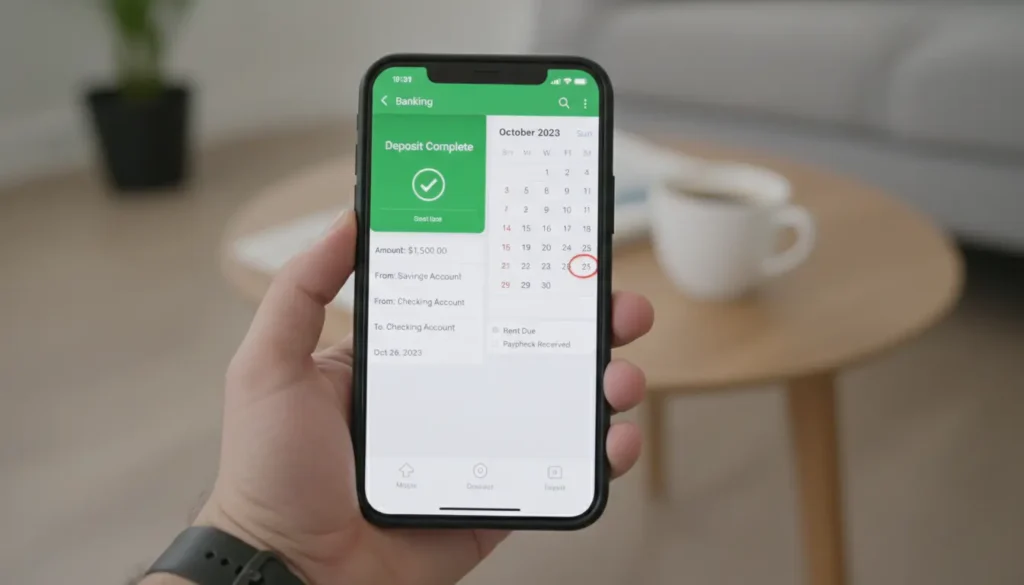

“Federal 2000 direct deposits” refers to a federal payment of $2,000 sent electronically to an eligible recipient’s bank account. The issuing agency delivers funds via the Automated Clearing House (ACH) network, and banks post deposits according to standard ACH rules.

Key Rules for January 2025 Federal 2000 Direct Deposits

Federal direct deposits follow established banking and federal program rules. Understanding these rules helps recipients know when funds will appear and why delays sometimes happen.

Eligibility and enrollment

- Only recipients identified by the issuing agency are eligible. Eligibility often depends on income, benefits status, or program sign-up.

- Recipients must have provided correct routing and account numbers. Mistakes cause rejections or paper checks.

- Agencies may require enrollment windows or specific forms to qualify for the payment.

Payment authorization and transmission

Agencies authorize payments and send them to the Treasury or its payment processor. The processor formats ACH files and transmits them to receiving financial institutions. This technical chain sets the basic timeline.

Typical Timeline for January 2025 Federal 2000 Direct Deposits

The timeline below is a practical example of how federal ACH payments move. Use it as a planning tool rather than a guaranteed schedule.

- Announcement: Agency announces payment program and dates (T minus 10 to 30 days).

- Authorization: Agency finalizes the payment file and sends approval to the Treasury or payment vendor (T minus 7 days).

- Transmission to banks: ACH file sent to banks, typically overnight, for settlement on the intended payment date (T day).

- Bank posting: Most banks post ACH credits on the settlement date or the next business morning. Posting time varies by bank processing cycles.

- Notification: Recipients may receive an account notice, and the agency may send confirmation emails or portal updates.

Example schedule: If an agency targets January 17 as the settlement date, banks could post funds early on January 17 or in the morning of January 18 if weekends or holidays intervene.

Weekend and holiday impacts

ACH settlement happens only on business days. If the scheduled deposit date falls on a weekend or federal holiday, the actual posting usually occurs on the preceding or following business day, depending on the agency’s direction.

Common Exceptions and Delays

Several factors can delay a federal $2000 direct deposit. Knowing them helps you troubleshoot if funds don’t appear as expected.

- Incorrect bank routing or account numbers cause ACH returns and may trigger a mailed check.

- Bank processing cutoffs: Banks with late daily cutoffs may not post ACH credits until the next business day.

- Fraud or compliance holds: Banks sometimes place temporary holds for verification on large or unusual deposits.

- Agency data errors: Name mismatches or duplicate entries can delay processing.

What to do if you don’t receive the deposit

- Check your online account and transaction history for pending ACH credits.

- Verify routing and account numbers with the issuing agency or your bank.

- Contact the agency’s help line or Treasury’s payment support if many days pass after the announced date.

- Keep documentation: announcement notices, confirmation emails, and bank statements help resolve disputes.

How to Prepare for January 2025 Federal 2000 Direct Deposits

Preparation reduces the chance of a delay and helps you access funds faster.

- Confirm and update your bank routing and account numbers with the issuing agency well before the announcement date.

- Opt into direct deposit through your agency account or benefits portal if required.

- Monitor agency announcements and your email for specific payment dates and eligibility notices.

- Plan for possible short delays by keeping emergency funds available in case the deposit posts later than expected.

Security tips

Use official agency websites or direct phone lines to update payment info. Beware of phishing emails claiming to need banking details for payment—agencies rarely ask for full account credentials by email.

Real-World Example: Retiree Case Study

Maria, a retired teacher, expected a $2,000 federal payment in January 2025. She had her direct deposit on file with the federal benefits office and watched for the agency’s announcement.

The agency announced the payment date two weeks in advance. On the scheduled settlement date the ACH file was transmitted; Maria’s bank posted the credit early the next business morning. Because her account information was current and she used the bank’s online alert, she learned the funds were available quickly and avoided a delay.

Lesson from the example

Keeping account information current and monitoring official notices are simple steps that minimized Maria’s risk of delay.

Final Checklist Before the Payment Date

- Verify enrollment and eligibility with the issuing federal agency.

- Confirm routing and account numbers at least one week in advance.

- Make sure your bank account is active and able to receive ACH credits.

- Watch the agency’s official communications and set account alerts with your bank.

When you follow these rules and timelines, you reduce uncertainty and improve the odds that a January 2025 federal $2000 direct deposit will arrive on schedule.